Wisdom Driven Financial Planning

Treece INC empowers you to build wealth, eliminate debt, and retire with confidence.

Book a consultation

Check out what Forbes is saying about IUL's

A few examples of a few different programs

you could benefit from

Life Insurance

A Powerful Financial Tool You Might Be Overlooking

Have you ever thought about how life insurance could do more than just protect your loved ones? What if it could also help you build long term wealth and support your financial goals while you're still alive? Modern life insurance policies can be powerful financial tools offering benefits like tax advantaged cash value growth, access to funds during emergencies, and even supplemental income during retirement. How would it feel to know your policy is working for you in both life and legacy planning? Imagine the peace of mind that comes from knowing you're not only protecting your family’s future but also strengthening your own financial foundation today..

Mortgage Protection

Securing Your Home, Securing Your Peace of Mind

What would happen to your home if something happened to you or your income suddenly disappeared? For many families, the mortgage is the largest monthly expense and losing the ability to pay it could mean losing the place they call home. Mortgage protection insurance is designed to step in when life doesn’t go as planned, helping ensure your loved ones aren’t burdened with payments they can’t afford. How reassuring would it feel to know your family could stay in their home, even in the face of illness, disability, or an unexpected passing? What would that kind of security be worth to you not just financially, but emotionally? With the right protection in place, your home becomes more than an asset; it becomes a legacy.

Final expense

A Thoughtful Way to Ease the Burden

Have you ever thought about who would be responsible for your funeral costs, medical bills, or other final expenses? It’s not easy to talk about, but planning ahead can be one of the most caring decisions you make. Final expense insurance is designed to cover these costs so your loved ones aren’t left scrambling or going into debt during an already emotional time. How would it feel to know that everything is taken care of, down to the smallest detail? What kind of relief would that bring to your family, knowing they can focus on healing rather than finances? With final expense coverage, you’re not just planning for the end you’re protecting those you love from unnecessary stress when they need comfort the most.

Late Stage

College Planning

It’s Not Too Late to Make a Smarter Move

Have you ever looked at the rising cost of college and wondered how your family will afford it

without sacrificing retirement or taking on overwhelming debt? If your child is in high school and college is around the corner, you might feel like you’ve missed your window to plan. But what if the most important financial moves are still ahead of you? Late stage college planning helps families navigate financial aid, reduce out of pocket costs, and make informed decisions even if college is just months away. How would it feel to avoid draining your savings or over borrowing, simply because you had the right strategy at the right time? And what would it mean to send your child off to college without the burden of financial stress hanging over your family? The truth is, it’s not too late it just takes a smarter plan.

Tax Free Retirement

A Smarter Way to Secure Your Future

Have you ever asked yourself how much of your retirement savings you’ll actually keep after taxes? Many people rely solely on 401(k)s or traditional retirement accounts, not realizing they’re building a tax bill for the future. What if there were a way to grow your savings with stability, protect your wealth from market volatility, and access your money in retirement tax free? Some life insurance programs offer exactly that combining long term cash value growth with tax advantaged withdrawals and death benefit protection. How would it feel to know your retirement income isn’t at the mercy of the market or the IRS? What kind of peace of mind would that give you, knowing you're in control of your financial future while also leaving something behind for the ones you love? With the right strategy, retirement can be about freedom not uncertainty.

401k Roll overs

Take Control of Your Retirement Before the Market or Taxes Do

Have you ever wondered what kind of control you really have over your 401(k)? Many people leave their retirement funds sitting in an old employer plan, exposed to market swings and future tax hikes without even realizing it. What if you could move those funds into a safer, more flexible option that gives you more control, reduces risk, and even allows you to plan your taxes on your terms? Rolling over your 401(k) can give you access to retirement strategies that aren't tied to mandatory distributions at age 73, and may let you pay taxes now at today’s rates instead of gambling on what rates might look like in the future. How much more confident would you feel heading into retirement knowing you’ve locked in stability and kept more of what you've worked for? What would that kind of financial clarity be worth to you and your family?

Get out of debt faster

What If Getting Out of Debt Could Also Build Your Future?

Have you ever felt like you're working hard just to keep up with payments only to see little real progress? Traditional debt payoff plans often take years and don’t leave much room for building real wealth. But what if there was a smarter way to eliminate debt and grow your financial future at the same time? The Debt 2 Wealth system is a holistic approach that helps you pay off debt faster

without cutting corners, sacrificing lifestyle, or relying on risky market based strategies. Imagine redirecting the money you’re already spending on interest and turning it into a wealth building tool. How would it feel to watch your debt shrink while your savings grow? And what kind of freedom would that give you not just financially, but mentally? This isn’t just about getting out of debt; it’s about building a foundation strong enough to carry you toward financial independence.

Lead a comfortable life while we take care of your finances.

5000+

Clients helped agency wide

$1B+

our retirement specialists agency wide with all our partners have helped safe guard Billions of assets!!

2025 Articles

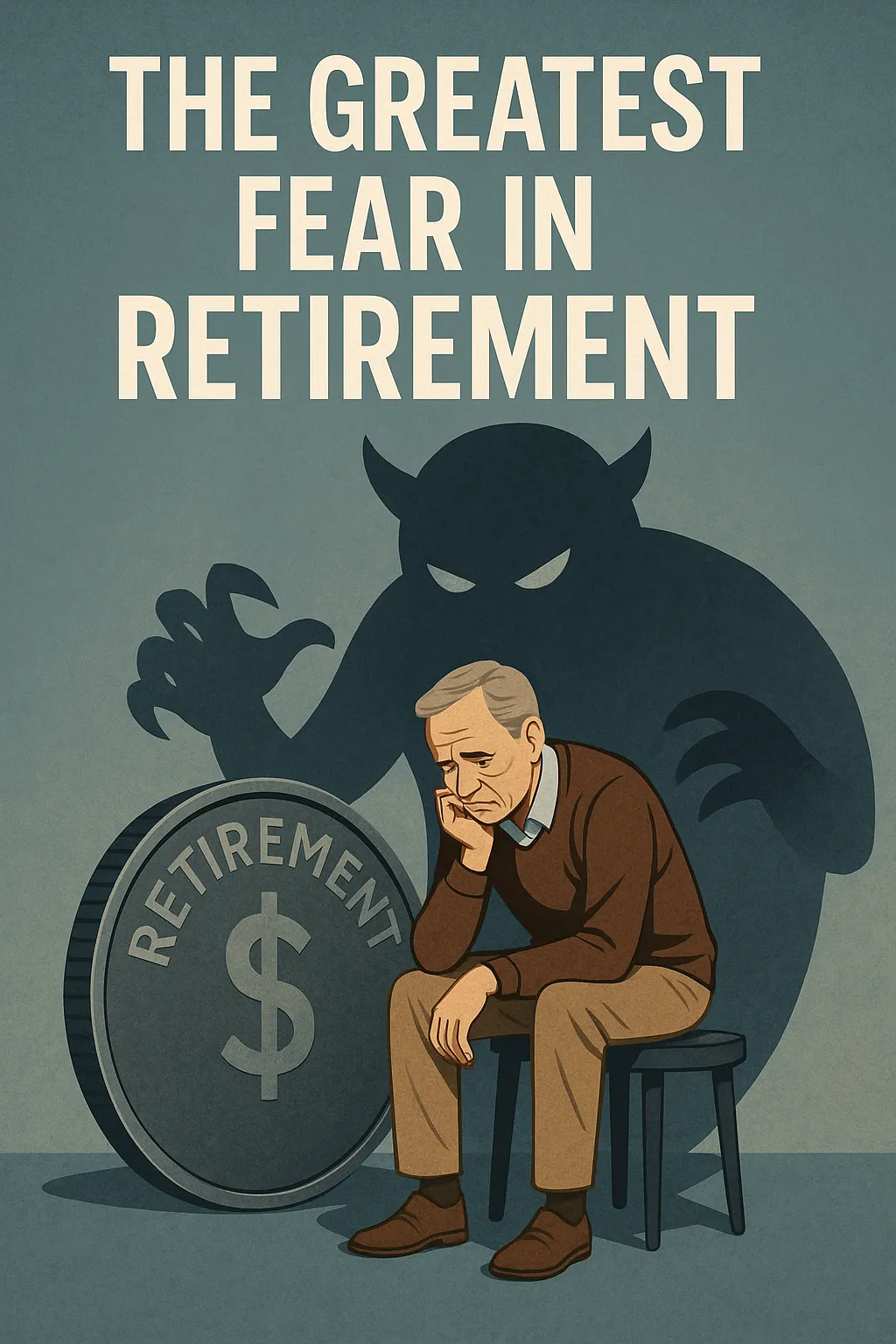

The Greatest Fear in Retirement

Outliving your money isn’t just a fear—it’s the #1 concern for today’s retirees. This in depth article explores why traditional retirement strategies often fall short and how rising costs, market uncertainty, and longer life expectancy can quietly sabotage your financial future. Learn how to build a retirement income you won’t outlive—and create peace of mind for the decades ahead.

How to Build Wealth

Tired of watching your retirement accounts swing with every market headline? This article breaks down how you can grow your wealth using smart, safe, and secure indexing strategies—without risking it all in the stock market. Learn how tools like FIAs and IULs can offer principal protection and reliable income for your future.

Debt to wealth

What if your debt wasn’t a weight holding you back—but a tool to launch you forward? This revealing article shows how you can use insurance backed strategies to eliminate debt faster and build lasting wealth at the same time. Discover the system that’s helping families all over the country flip the script on traditional finance.

The retirement you want

You may dream of a peaceful retirement—but are you actually on track for one? This must read article explores the growing gap between retirement expectations and reality, and how to pivot now using proven strategies like tax free growth, guaranteed income, and inflation protection to reclaim the future you envisioned.

The Silent Threat

Most people focus on how much they can save for retirement but few consider how much they’ll keep. This powerful article exposes the hidden threat taxes pose to your 401(k) and IRA, and how you can pivot now to protect your income from the rising tax tide.

Don't take our words for it, Hear from our clients

George Owens

"Michael at Treece Inc. gave me clarity and confidence about my retirement for the first time. Michael took the time to walk me through tax free strategies I didn’t even know existed. I moved forward with an IUL and I’m already seeing how it’s going to benefit me long term. I highly recommend booking a consultation you won’t regret it."

Max Tanner

"I came to them drowning in debt and skeptical of anything ‘too good to be true.’ But their Debt 2 Wealth plan completely changed how I manage my money. I’m on track to be debt free years sooner, and I’m even building savings at the same time. This isn’t just another financial firm they actually care and educate you."

Kim Wexler

"As a single mom planning for the future, I was overwhelmed by all the noise out there. Michael was kind, patient, and extremely knowledgeable. He helped me set up a college savings plan and a life insurance policy that builds cash value. I finally feel like I have a real plan for my kids and my future."

Billy Jackson

"What impressed me most was how personalized everything was. It wasn’t just about selling a product it was about building a strategy that fit my goals. We discussed my 401(k) rollover options, tax free income, and how to set up guaranteed income in retirement. I’ve already referred two coworkers."

© 2017 Treece INC

All Rights Reserved